The Deputy Chairperson of Nambawan Super, Dame Meg Taylor, yesterday announced that in 2021 the Fund has grown its net asset value to K8.82 billion, earning a net profit of K526 million that has been distributed to more than 208,000 members through applying a crediting rate of 6.5% to their accounts.

Dame Taylor said that the Nambawan Super Limited (NSL) Board and Management had worked tirelessly to overcome the challenges of the Coronavirus Pandemic to deliver good returns for their members and they were pleased with the overall performance of the Fund in 2021.

“It is pleasing that we will be kicking off 2022 with news of a good result from last year. As 2022 also marks Nambawan Super’s 60th Anniversary of service to our members, builing better futures, throughout PNG”, Dame Taylor said.

“As a profit-to-members fund, generating profits that we can return to members is our highest priority and we are proud to have been doing this for 60 years, cementing Nambawan Super as PNG’s best superannuation fund over the long-term.”

“After a tumultuous year in 2020, we were determined to overcome the challenges of the Pandemic and continue to deliver satisfactory results for our members.”

“Over the past 10 years our Asset base has more than doubled,”

Dame Taylor reiteriated “Our Asset base is our Members’ savings which means the wealth of members has doubled over the past decade.”

“Nambawan Super’s compound average returns over the past 10 years are 7%, almost a full 2% over the national CPI for the period, which means real returns to members”, Dame Taylor explained.

“We hope that members will also be pleased by these results when they see the interest payments credited into their accounts over the next few days.”

Dame Taylor explained that 2021 has not been without its challenges and the Fund had to work hard to achieve these results.

She added, “The Pandemic is still here and we expect these tough global economic conditions to continue, however, we have been working hard to adapt our approach to investments and operations to ensure that we are continuing to deliver for our members regardless of the challenges faced.”

“The positive results of 2021 can be attributed to our continued efforts to diversify our investment portfolio to improve on our risk/return ratio. This means that we are spreading our investments over several local and international bonds and equities, as well as in properties and domestic cash to ensure that we continue to generate returns even when some investments are not performing as well as expected”.

Dame Taylor pointed out that NSL uses an effective investment strategy, aligned to the prudential standards of the Superannuation (General Provisions) Act 2000, to manage the risk of adverse outcomes for individual investments.

“Compared to 2020, our investment performance was stronger across all asset classes. Fifty million kina increases in both interest and dividend payments have provided cash for the fund to reinvest”, Dame Taylor added.

“BSP performed very well – returning 80 million kina for our members. Part payment of rental arrears owed by the State in 2021 also has had a positive impact on 2021 results. In particular – compared to 2020 – valuation has rebounded, from a 225.4 loss last year, to 61.5 million kina gain in 2021.”

Dame Taylor stated that outside of financial returns for members, the Fund has also delivered several achievements for members in 2021. These achievements include:

- The Fund received K50 million from the State in December 2021, in partial payment of their outstanding rental arrears. NSL continues to work with the State and has again called on the State in early 2022 to meet its obligations before entering the election period.

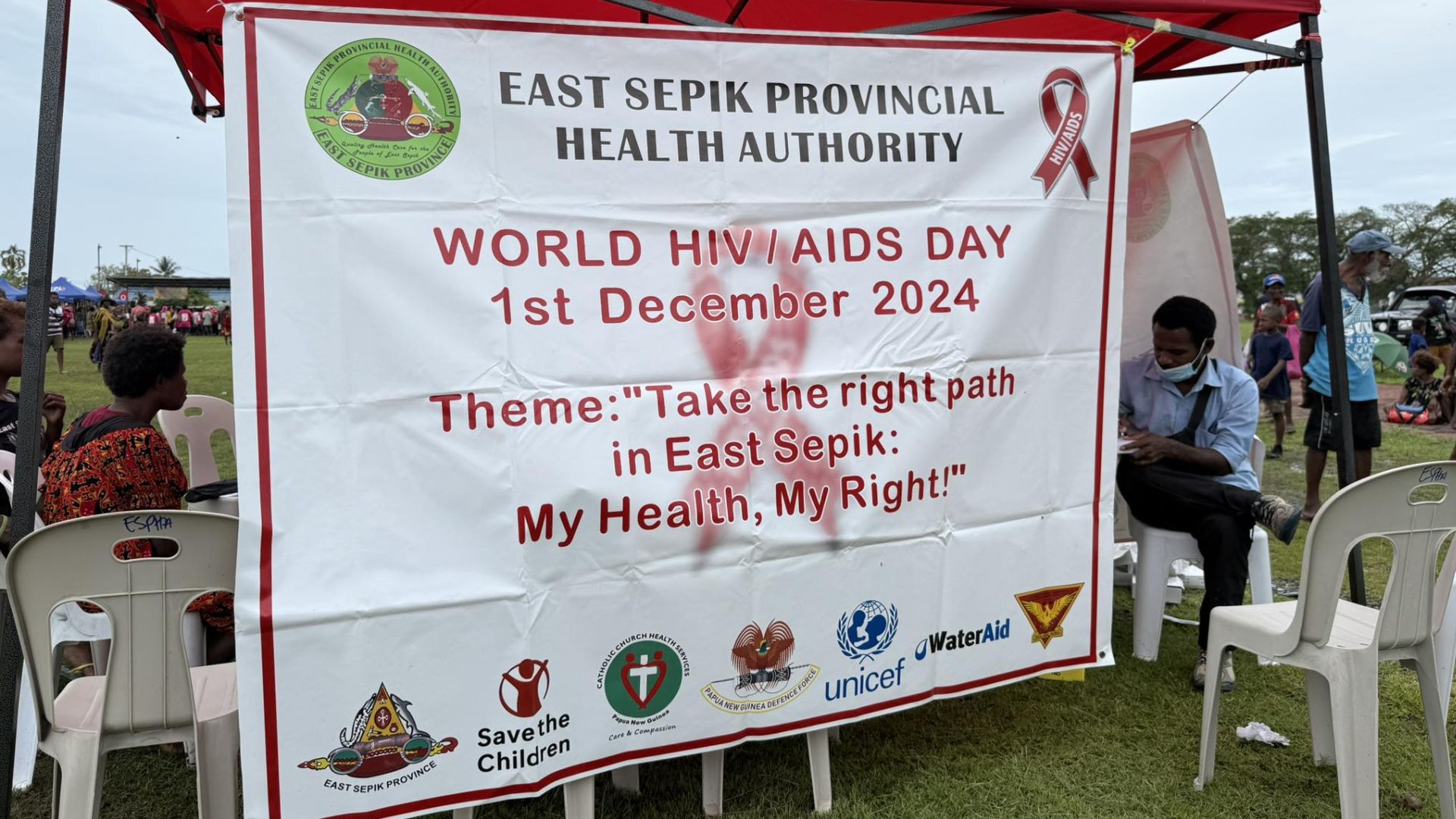

- New Branch opened in Maprik to provide better access to services for this growing East Sepik township.

- The Fund retained 5,584 members through Retirement Savings Accounts (RSA) with K192 million in funds, which is a rise of 12% in membership and a 17.5% increase in RSA Funds Under Management.

- NSL’s Financial Literacy Training was built and rolled out to 351 members in 2021, with more members already being trained in 2022.

- There was a notable improvement in State Share payments, including the State prepaying some members' contributions, which enables them to seamlessly exit the fund.

- NSL appointed two very capable Papua New Guineans in Mr. David Kitchnoge and Mr. Pochon Lili to the positions of Chief Investment Officer and Chief Financial Officer, respectively.

Dame Taylor also spoke about the Funds outlook for 2022 and outlined some of the challenges it expects to encounter.

A key challenge that the Fund is mindful of is the intention of the State to impose unfavourable tax reforms which will diminish returns to members including a possible Capital Gains Tax (CGT) and the already legislated Market Concentration Levy.

Dame Taylor explained, “The CGT would be unfavourable for Superannuation contributers if special concessions aren’t applied for Super Funds.”

“We have already called on the Government to repeal the Market Concentration Levy to be imposed on the Banking and Telecommunications sectors, as it would lead to all super fund members losing over K317 million in asset values and reduced dividends, in just the first year”.

“After considering the immediate impact on BSP’s price to earnings ratio and the resulting value erosion, it is estimated that in the first year alone, the members’ crediting rate may be reduced by as much as 2% which translates to about a K160 million loss of members’ returns.”

“Nambawan Super already pays substantial taxes and many of our investment business are also already highly taxed. We are not looking for special treatment, we are simply asking for fairness in protecting our members retirement savings.”

“Nambawan Super will continue to work with key stakeholders and industry players to advocate for the protection of our members' savings as our highest priority.”

Dame Taylor went on to say that the Fund is expecting many more challenges ahead but also just as many opportunities in 2022 and further.

“We are aware that the current economic environment is producing higher inflation and lowering interest rates which makes it more challenging to generate real returns for members”, she continued.

“However, we are optimistic that with Superannuation and Life Insurance reforms due soon, which may result in positive changes for the Fund, in particular in areas where we have advocated such as making super available for everyone and favourable taxation, especially on Retirement Saving Account members.”

In closing, Dame Taylor thanked Nambawan Super’s Board, including Directors who retireed from the Board in 2021, Executive, Management and especially the NSL staff for their hard work and contribution to the 2021 results.

“Finally, I would like to once again encourage our members and all Papua New Guineans to continue prioritising saving for your future as it is the first and most important step in securing a more comfortable and happy life after retirement.”

“I also thank our members for trusting us with your savings and working with us to grow your wealth over the last 60 years, we are proud to have helped build better futures for our members and aim to continue doing so long into the future”, Dame Taylor concluded.

Key figures:

- 2021 net asset value was K8.82 billion and had rose by 8.4% equating to a K680 million increase.

- The Fund recorded a record net profit of K526 million which climbed by K437 million from 2020.

- The 6.5% return is excellent in challenging economic conditions.

- The management expense ratio remained at 1%

- Total contributions for 2021 were K935 million which is an increase of K134 million.

- Total member payouts were K778 million, an increase of K337 million.

- K88 million paid to members in Housing Advances which rose by K48 million since 2020.

- Members contributed K37 million voluntarily in 2021 and membership grew to 30,391 members with voluntary Funds Under Management totalling K244 million