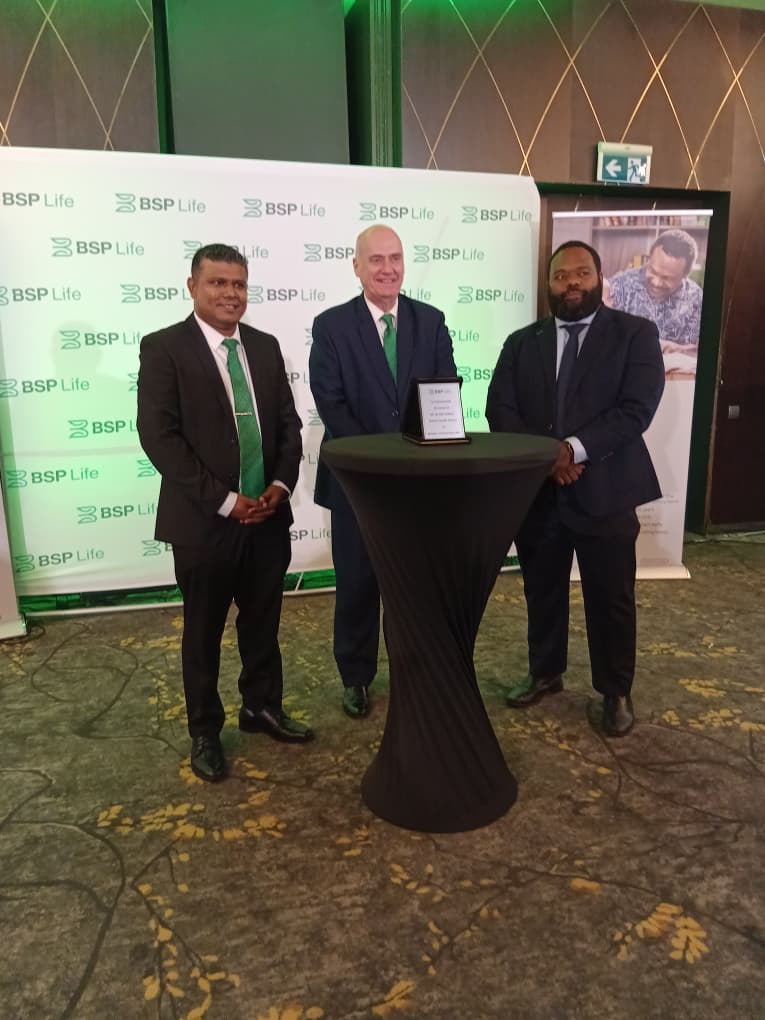

BSP Life has officially launched its new endowment product, Wantok Sumatin, aimed at helping Papua New Guineans better plan for future financial needs, particularly education.

BSP Life entered the PNG market in January 2018 with its flagship product, Wantok Delite, which now has more than 11,000 policy holders.

Since its establishment, BSP Life PNG has paid over 2,300 claims worth K60 million and under the Wantok Delite product alone, an additional K5.5 million in survival benefits has been returned to 1,800 families.

“These are not just numbers,” said BSP Life Country Manager Nilson Singh.

“These are widows who could pay for funerals, retirees who could build homes, and families who trusted us and we delivered.”

Mr. Singh highlighted that fewer than 3% of Papua New Guineans have life insurance, largely due to limited awareness and low trust in the insurance sector.

He stressed that planning for unexpected events is crucial, especially when it concerns children’s education.

“The Wantok system is the heart of PNG’s culture, but it cannot carry every financial burden.”

“This is the gap that Wantok Sumatin has been designed to fulfil.”

School fees remain one of the biggest financial pressures on families, often forcing parents to borrow money or conduct fundraisers.

Wantok Sumatin offers a structured solution with benefits including 20% cash payouts of the sum insured during the final five years of the policy term along with annual bonuses added to the policy.

Policy holders pay premiums for the first 10 years and BSP Life covers the remaining years of the term.

Eligibility starts at 5 years old and extends to a maximum entry age of 59.

Customers can choose from 10-year, 15-year, or 20-year policy terms.

Payment options include salary deductions, direct deposit, electronic transfers, and internet banking.