Wabag in Enga Province is deemed the least populous provincial capital in the country. It is situated on the Lai River and the Highlands Highway passes through the town between Mount Hagen and Porgera. Nestled in this town, is one of Bank South Pacific Financial Limited (BSP) top mobile merchants Esrae Trading, an active advocate for cashless ecosystems and a frontline financial inclusion touch point, educating its consumers on the convenience and economic benefits to pay using mobile payments. This SME retailer continues to influence the payment landscape by driving cashless payments through Mobile Payments, they burst on the scene early this year generating the 2nd highest transaction volumes across Papua New Guinea. Consumers within Enga province are embracing the paradigm shift for to mobile banking, a far more secure way to transact.

Elsie Sumnan, shop owner stated, “My customers are educating each other on how to pay using mobile payments. When a customer makes a purchase successfully on their phone, word gets out as part of the awareness and more and more people are starting to pay with their phone”. I continue to teach my customers on mobile payments and how it is cheaper for them to pay, I tell them, mobile banking is convenient as you just use your one bang phone (feature phone), you don’t need credit just dial *131#, and I make sure they know it’s cheaper than EFTPoS and card, the bank fees 10 toea tasol.” Elsie added, “My customers know they have a cheaper option to get cash back using mobile banking as opposed to using their cards to get cash out. I can help provide this banking service to the customer and for me as a merchant, there is no fee”.

The Payment Landscape continues to evolve at a growing pace with consumer needs and/or demands pushing for advanced convenience and cheaper options to purchase goods and services, household items, and utility payments.

BSP understands that Digital adoption will encounter geographical dependencies considering the service availability and reach, specifically within rural PNG. This financial gap provides opportunity to resolve payment constraints through the enhancement of existing digital solutions, focusing mainly on the mobile banking platform.

BSP is considered a digital enabler for the masses, we assess channel adoption by the large masses, and we recognize the significance of our mobile banking USSD Platform, it is a critical rail that allows BSP to reach into the most rural areas of PNG and influence financial inclusion.

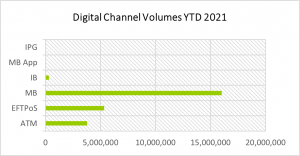

USSD Mobile Banking remains the highest transacting channel, with free air time sessions, and no limitation to a smartphone device, it effectively allows customers to conduct payments on any hand-held device at any time. Recently, introducing the Mobile Merchant solution as an enhancement to the channel allows Businesses to participate by conducting P2B Payments or direct account-to-account transactions through *131# for goods and services rendered.

USSD Mobile Banking remains the highest transacting channel, with free air time sessions, and no limitation to a smartphone device, it effectively allows customers to conduct payments on any hand-held device at any time. Recently, introducing the Mobile Merchant solution as an enhancement to the channel allows Businesses to participate by conducting P2B Payments or direct account-to-account transactions through *131# for goods and services rendered.

On record, the Mobile Merchant solution continues on an upward trend in transaction volumes with the NCD region and Highlands accommodating for 31% of transactions. . Local SME and Large Corporate Merchants are adapting to this payment medium, as a cheaper alternative. Merchants are prompting consumer usage through emphasis on the productivity gains offered, from instant payments, reduced transaction fee of 0.10t, and minimising reconciliation challenges for their business.

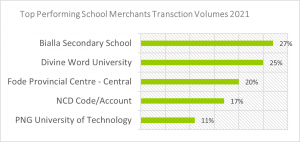

Annual payment for education is one of the most common transactions in branches, but recently schools and education institutions have adopted the persona of a merchant to receive payments through mobile banking. The

NGI Region have quickly adopted the BSP Mobile Merchant for digital payments, as reflected with Bialla Secondary School as the overall top performing secondary institution, as the school continue who are influencing parents to utilize mobile service to pay for school fees. This is followed by Divine Word University as the highest transacting tertiary institution. Increasingly Parents in the region are becoming digitally aware of the convenience and ease of making payments, also demonstrated in urban NCD and even in the Momase Region.

In overview of our neighboring countries in which BSP operates there is signifying similarity in channel adoption such as in Samoa, Fiji, and Solomon Islands. Each Offshore branch identifying high penetration of mobile devices as a medium for progressive growth within the Digital Payments realm.

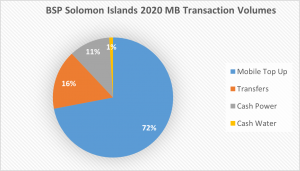

Solomon islands has a 49% subscriber penetration out of a population of 600,000+, since than BSP Solomon Islands has seen a positive growth of 33% in mobile banking users at the  close of 2020. Increased usage and adoption was largely due to the introduction of the Cash Water Service, allowing for an increment of 14% in financial activity. The top Performing channels remain as Mobile Top Ups, Transfers, Cash Power, and Cash Water generating high transaction volumes.

close of 2020. Increased usage and adoption was largely due to the introduction of the Cash Water Service, allowing for an increment of 14% in financial activity. The top Performing channels remain as Mobile Top Ups, Transfers, Cash Power, and Cash Water generating high transaction volumes.

Fiji has recorded 65.7% mobile connections, reaching 1.25mil of the population. BSP Fiji mobile banking customers continues to grow towards 100,000 users signaling the opportunity for growth expansion by introducing functionalities such as account alerts and airtime top up.

BSP’s primary focus is to expand reach and adoption for financial inclusion for our people in all regions throughout the country and in the Pacific; and by creating an enabling environment for alternative payments using mobile connectivity brings economic benefits for basic banking services. Once the bank completes implementation of our new core banking system, new and improved enhancements to our mobile banking platform will be available to all our customers including our Pacific markets.