The Center for Excellence in Financial Inclusion (CEFI) in its effort to implement National Government policies on achieving financial inclusion, has partnered with the Department of Education (DOE) to start rolling out financial literacy curriculum in schools in the country.

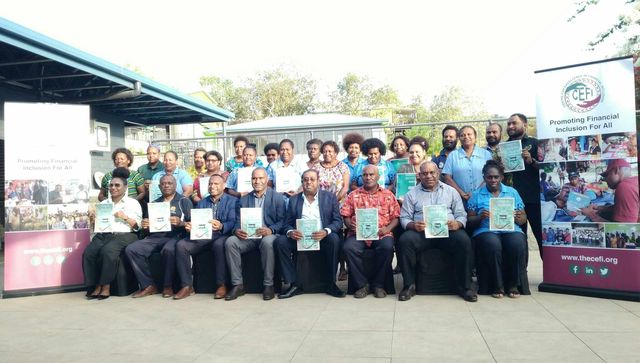

This was achieved when 21 books, comprising of seven Teacher Resource Books, Student Activity Books and Syllabuses each, were launched on Friday 1st November.

These books were developed following an intensive two weeks of workshop involving teachers, textbook content writers from the DOE and a team from CEFI who put their heads together to develop the financial literacy curriculum.

These books were launched at the Tuhava Resort in Central province just an hour’s drive outside the city of Port Moresby where the two- week workshop was held.

The Deputy Director for CEFI Mr. Peter Samuel in his opening address said the launching marked a significant event in the history of Papua New Guinea (PNG).

It’s about teaching the young generation about good financing in the future, he said.

This is the first of its kind for PNG to have financial literacy taught in schools to the next generation of Papua New Guineans, to better help them to make wise financial decisions in the later part of their lives, when they become adults.

Although other subjects like economics, business studies or accounting are taught in secondary schools, financial literacy, which is the ability to understand and effectively use various financial skills like personal financial management, budgeting and investing, are not taught from the primary level of education up.

Mr. Samuel added that teaching one to be financially literate not only helps one to make better financial choices, but it will also contribute to the whole economic growth of the country going forward.

The DOEs first Assistant Secretary for the Curriculum Development Division, Mr. Alex Magun, said the next step now is to train teachers to teach the subject to the students in schools, further stating that it is the perfect time to inject the subject into educating the young generation to be financially literate.

Meantime, CEFIs Executive Director Mr. Saliya Ranasinghe said the outcome of the development of the financial literacy curriculum also shows the hard work put in by both organisations over the years, collaborating to finally have the subject finalized, approved and then progress into classrooms.

He added that financial literacy is the main focus to drive financial inclusion in the country, which comes under the focus of the government captured in its development plans like Vision 2050 and the Medium-Term Development Plan (MDTP) 4. And achieving this outcome of having the financial literacy subject taught in schools is a tick in the government’s plan.

This curriculum is expected to be taught in schools initially for Prep to grade 6 only, from next year and beyond.

Meantime, the development of syllabuses for the secondary level of education is in progress and should be launched as well in the near future. A syllabus is a legal document, a policy paper document for the DOE that actively tells what kind of curriculum should go into the classroom.